What Is Loan Management System?

Loan Management System (LMS) is a digital platform that automates and manages every stage of the lending lifecycle — from loan origination and underwriting to disbursement, repayment, and closure. Whether you're a traditional bank, NBFC, fintech, or microfinance institution, an LMS helps reduce manual work, improve compliance, and deliver faster, smarter, and more secure lending experiences.

With rising competition and regulatory pressure, adopting a cloud-based loan management software is essential for modern lenders looking to scale their operations while staying compliant.

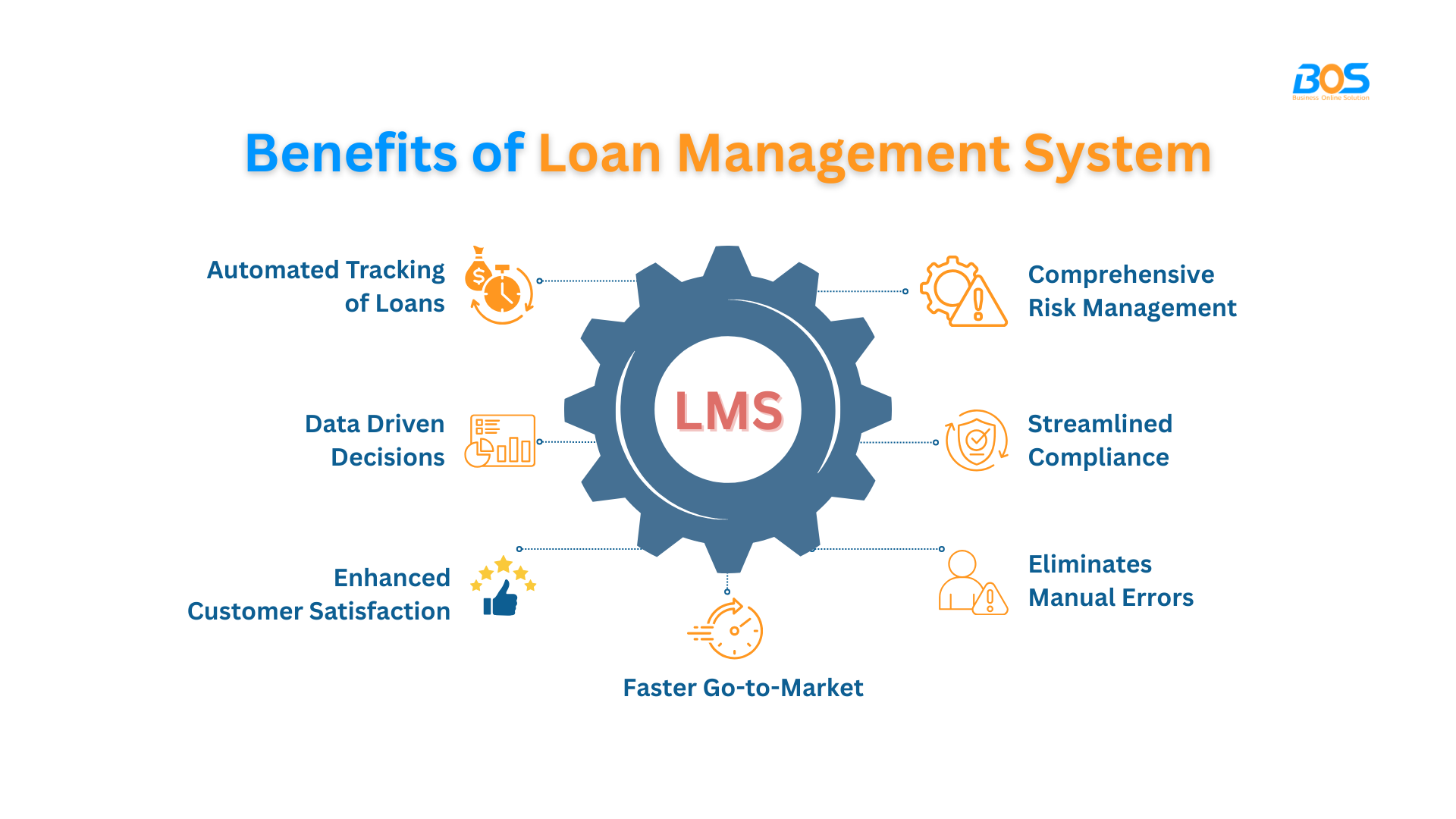

Benefits of Loan Management System

Implementing a robust LMS delivers numerous benefits for lenders of all sizes:

Faster Loan Processing

Automate tedious workflows and reduce approval times from days to minutes.

Regulatory Compliance

Stay audit-ready with built-in compliance checks and documentation.

Risk Mitigation

Integrate credit scoring, fraud detection, and real-time monitoring.

Improved Customer Experience

Enable self-service portals, instant notifications, and faster disbursements.

Operational Scalability

Handle high loan volumes with ease through process automation and cloud scalability.

Capabilities of Loan Management System

Modern LMS comes packed with features designed to support a wide range of lending workflows:

End-to-end loan lifecycle management

Automated KYC, credit scoring, and underwriting

Custom loan product configuration

API integrations with CRMs, bureaus, and payment gateways

Repayment scheduling and auto-debit

NPA tracking and delinquency management

Audit trails, real-time dashboards, and reporting

Cloud-based deployment with mobile accessibility

Simplify loan origination with automated KYC, Credit checks, & Workflows

Go digital with BOS LMS

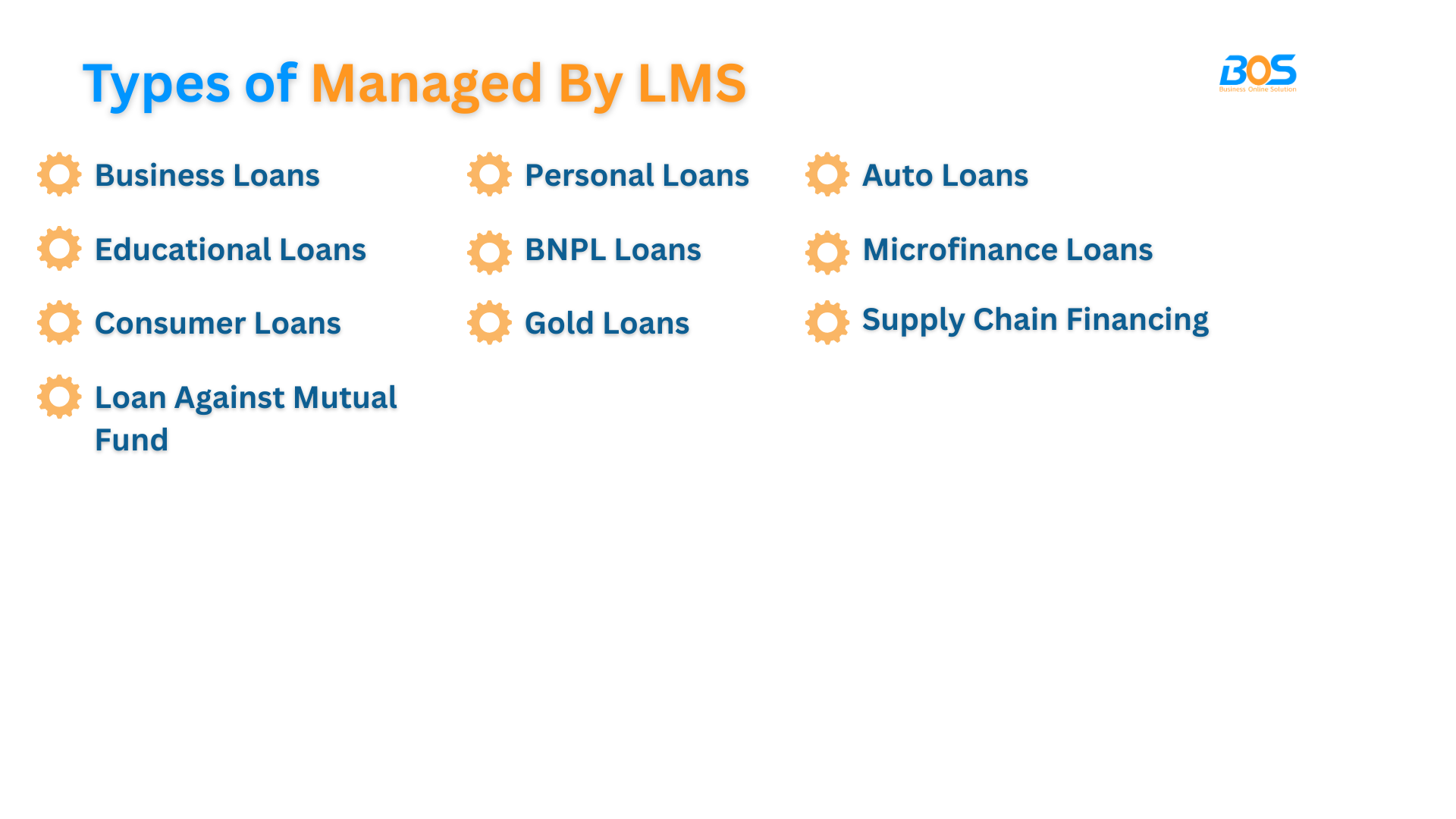

Schedule a personalized demo today!Types of Loans Managed by LMS

Gold loans offer liquidity with minimal risk, and LMS helps manage these secured loans efficiently. By automating asset verification, loan approvals, and repayment tracking, LMS speeds up the entire process, helping lenders manage higher volumes while ensuring full compliance with regulations.

BOS Gold Loan Solution automates valuation, risk management, and compliance for efficient secured lending. It features a two-step gold valuation, packet tracking, and an integrated appraiser module for accurate assessments. Lenders benefit from flexible schemes (regular, step-up, rebate), partial asset release, and RBI-compliant cash vs. bank disbursement splits. The Gold Movement Module enhances inventory tracking across branches, while self-release and auction management streamline servicing. Built on a scalable SaaS framework with CRM integration, LMS by BOS ensures secure, efficient, and compliant gold loan management.

Conclusion

Adopting a Loan Management System (LMS) is no longer just an option, it's a necessity for lenders who want to stay ahead of the competition. Whether managing personal loans, business financing, or BNPL solutions, LMS by BOS is a reliable partner to help you expand your lending operations.

Ready to revolutionize your lending business?

Schedule a demo with us today.